Bajaj Finserv Large and Mid Cap Fund: A Beginner's Guide to Investing

Oct 30, 2024

NewsVoir

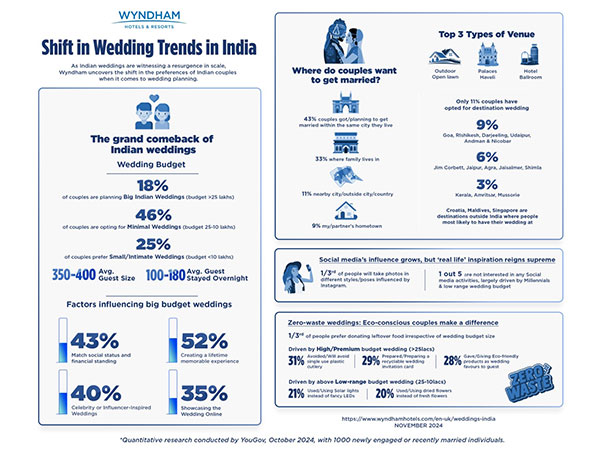

Pune (Maharashtra) [India], October 30: The large number of mutual fund schemes and types in the market can make it challenging for investors, especially those who are just starting out, to identify investment opportunities. For those who are looking to access long-term growth potential while mitigating risk, large and mid cap funds can be a suitable option. These funds seek to combine risk and reward by investing in relatively stable large-cap companies as well as growing mid-cap companies.

Bajaj Finserv Large and Mid Cap Fund follows a unique moat investing strategy, identifying and investing in companies that have strong competitive advantages.

This article tells you more about the Bajaj Finserv Large and Mid Cap Fund and how to invest in it.

What are large and mid-cap funds?

Large and mid-cap funds are mutual funds that invest in a mix of large and mid-sized companies. Large-cap companies are well-established businesses that tend to be industry leaders. This makes them relatively stable. On the other hand, mid-cap companies are those that are still in a stage of rapid expansion and have the potential to turn into large-cap companies in the future. These companies come with a higher growth potential but also carry a greater risk compared to large-cap companies.

Investing in such a fund helps investors to combine the relative stability of large cap companies with the enhanced growth potential of mid caps.

Moat investing and Bajaj Finserv Large and Mid Cap Fund

To further optimise this risk-reward balance, the Bajaj Finserv Large and Mid Cap Fund follows a most investing strategy.

A moat, in economics, refers to a competitive advantage that can protect a company's market position. Just like a castle's moat keeps invaders out, a business moat prevents competitors from eating into a company's market share. This could be due to several factors like a strong brand image, patented products, high customer loyalty, significant cost advantages, or a technological edge.

Fund managers select companies that have strong moats. Through this, they seek to build a relatively resilient portfolio comprising companies that can provide relatively stable growth in the long term, with less vulnerability to volatility. They also seek out companies that have the capacity to expand upon and build their competitive edge. Here are some of the features of such companies:

Pricing power: These companies can set or increase prices with minimal impact on the demand for their goods or services.

Market dominance: These businesses hold leading positions in their respective industries, often commanding a significant share of the market.

Leadership strength: Competent management teams play a crucial role in enhancing these companies' competitive edge.

Innovation: By embracing innovation, these companies respond flexibly to evolving market conditions.

Such companies can therefore be more resilient to economic downturns as their competitive advantages can create a bugger against market fluctuations, mitigating overall portfolio risk.

How to invest in Bajaj Finserv Large and Mid Cap Fund

Here's a step-by-step guide to investing in the Bajaj Finserv Large and Mid Cap Fund

1. Understand your financial goals: Are you looking for long-term growth potential, or do you want minimal risk to invested capital? Knowing your goals will help you choose the suitable fund and decide how much to invest. Those who are comfortable with some risk and have a long investment horizon can consider the Bajaj Finserv Large and Mid Cap Fund. Those seeking minimal volatility may prefer a debt mutual fund.

2. Identify an investment amount and frequency: A convenient way to understand how your investment can grow over time is by using a compounding calculator. This tool helps you see how your money can potentially grow based on your investment amount, expected rate of return and investment horizon. You can also adjust the investment amount and tenure till you find a combination that aligns with your goals.

3. Invest online or offline: You can invest in the Bajaj Finserv Large and Mid Cap Fund either online or offline. You can invest directly through Bajaj Finserv Asset Management Ltd or through a registered distributor or aggregator. To invest online, visit www.bajajamc.com and click on login/register on the home page. You will be redirected to the investor portal. If you are an existing investor, enter your PAN to sign in. Otherwise, you can sign up by providing your PAN and some basic information such as your bank account and contact information. Then, select the scheme and the investment.

You can invest in lumpsum or SIP. The minimum investment amount for both is Rs. 500.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)